At Finbridge, we know every business has unique goals and challenges. Our SBA loans are designed to fuel your growth, help you seize new opportunities, and overcome financial hurdles—all while keeping your long-term success in focus. With government-backed security, competitive rates, and personalized support, we simplify the financing process so you can concentrate on your vision.

At Finbridge, we know every business has unique goals and challenges. Our SBA loans are designed to fuel your growth, help you seize new opportunities, and overcome financial hurdles—all while keeping your long-term success in focus. With government-backed security, competitive rates, and personalized support, we simplify the financing process so you can concentrate on your vision.

An SBA (Small Business Administration) loan is a government-backed financing option that offers favorable terms to small and medium-sized businesses. Because these loans come with a government guarantee, lenders are more willing to offer:

Save on borrowing costs.

Enjoy extended payment schedules to ease cash flow

Benefit from a streamlined, digital process that delivers funding fast.

Government backing helps even businesses with limited credit history secure funding.

Navigating the world of SBA loans can be daunting. Say with us being your Financial Navigator at FinBridge we will be guiding you through each step with expert advice and a streamlined process. Our commitment is to make business financing simple and effective, ensuring you get the funding you need to propel your business forward.

Expert Guidance

Our experienced Financial Navigators work with you from start to finish, assessing your business needs and crafting a strong loan application

Tailored Solutions

We understand that every business is different. Our approach is customized to align with your specific financial goals.

Streamlined Process

We collaborate closely with SBA-approved lenders to reduce delays, so you can access funds faster.

Transparent Communication

Our dedicated team keeps you informed at every stage, ensuring you’re confident and up-to-date throughout the process

SBA loans are designed to support a wide range of business needs, whether you're launching a startup or expanding an established enterprise. Typically, eligible businesses include:

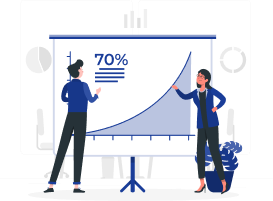

Startups & Growing Enterprises

Businesses with Clear Growth Potential

Turn a solid business plan into reality

Diverse Industries

From retail and manufacturing to technology and services, our financing solutions are built to support various sectors.

Improved Cash Flow

Invest in equipment, inventory, or working capital to maintain healthy cash flow.

Credit Building

Successfully managing an SBA loan can strengthen your business’s credit profile

Risk Mitigation

The government-backed guarantee reduces risk, encouraging responsible borrowing.

Financing should empower your business—not hold it back. With Finbridge SBA Loans, you gain a partner dedicated to guiding you through the complexities of business financing with ease and confidence. Our tailored approach ensures you receive the funding needed to unlock your growth potential.

Are you ready to transform your business?

Contact us today for a free consultation, and let Finbridge help you turn your vision into reality.

Finbridge—where your success is our mission.

It’s a government-backed financing option that offers lower interest rates, flexible repayment terms, and smaller down payments, making it ideal for businesses aiming to grow without overextending their resources.

Eligibility depends on factors like business size, revenue, credit history, and the loan’s purpose. Our specialists work with you to evaluate your unique situation.

Typically, you’ll provide financial statements, tax returns, a detailed business plan, and information about your current debts and assets. We guide you through every step.

While timelines vary based on complexity, many applications move from consultation to funding within a few weeks thanks to our streamlined process.

Rates and terms are based on your creditworthiness, the loan amount, and market conditions. SBA loans generally offer lower rates and more flexible terms compared to conventional loans.

Yes. The government guarantee on SBA loans helps mitigate risks associated with less-than-perfect credit, and our advisors work with you to highlight your business strengths.

Reach out to our sales department at [Your Contact Number] or fill out our online contact form for a personalized consultation. We’re here to help every step of the way.

At Finbridge, we don’t just handle transactions—we bridge businesses to their next level of success.